|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Best Mortgage Rates in Rochester NY: A Comprehensive GuideWhen searching for the best mortgage rates in Rochester, NY, it's essential to understand the factors influencing these rates and how you can secure the best deal. Rochester offers a variety of mortgage options, and understanding the nuances can save you thousands of dollars over the life of your loan. Factors Affecting Mortgage RatesCredit Score ImpactYour credit score is one of the most significant factors affecting your mortgage rate. A higher credit score generally means a lower interest rate, which can significantly reduce your monthly payments. Loan Type and TermDifferent loan types and terms can also affect the interest rate. For instance, a 30-year fixed-rate mortgage might have a different rate compared to a 15-year fixed-rate mortgage. Economic IndicatorsBroader economic factors, such as the current state of the economy and the market interest rate today, play a critical role in determining mortgage rates. How to Secure the Best RatesImprove Your Credit Score

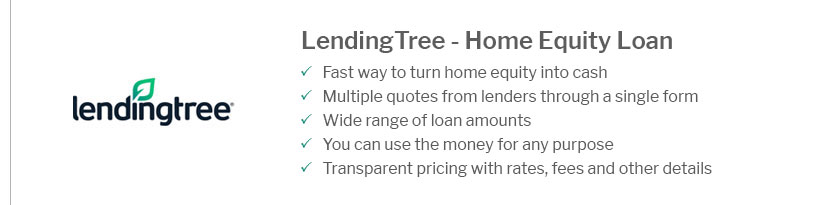

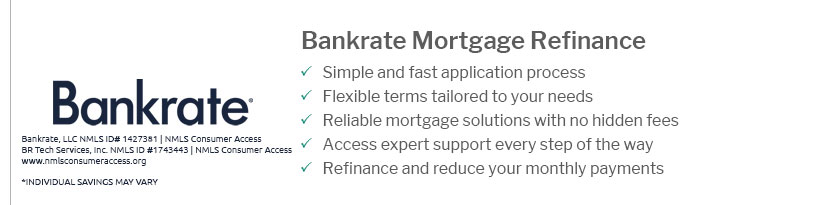

Shop AroundIt's crucial to compare offers from multiple lenders. Each lender may offer different rates and terms, so shopping around can help you find the best deal. Consider a Cash Out Refinance LoanIf you already own a home, refinancing with a cash-out option can sometimes offer better rates and allow you to tap into your home's equity. FAQ Section

https://www.esl.org/personal/mortgages/mortgage-solutions/fixed-rate-mortgage

225 Chestnut Street, Rochester NY 14604 Privacy Policy | Disclosures | Security. https://www.zillow.com/lender-directory/NY/BEST-Rochester/

Looking for a lender? - Haus Capital CorporationNMLS# 1549644. 4.92 - Oxford CapitalNMLS# 19883 - Mark N CataldoNMLS# 372091 - Oxford CapitalJeffrey Scott ...

|

|---|